Bollinger bands formula investopedia

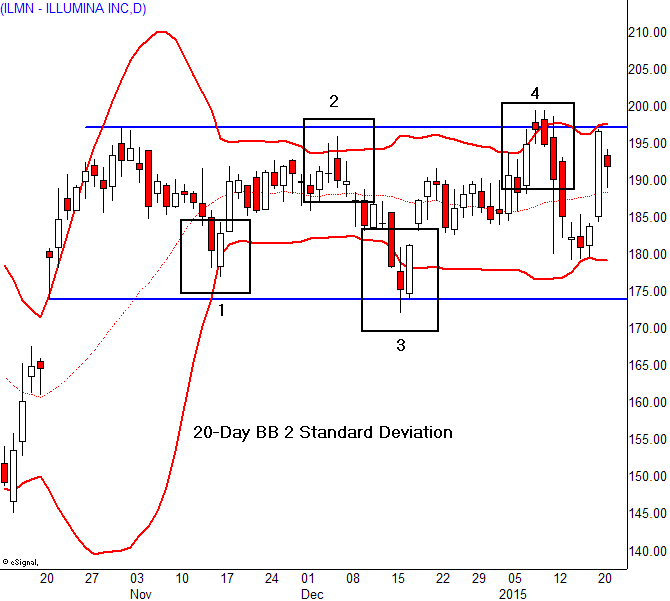

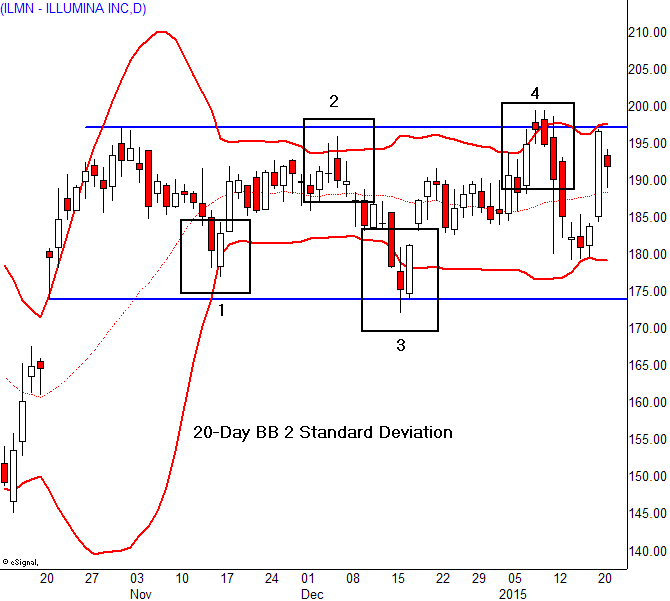

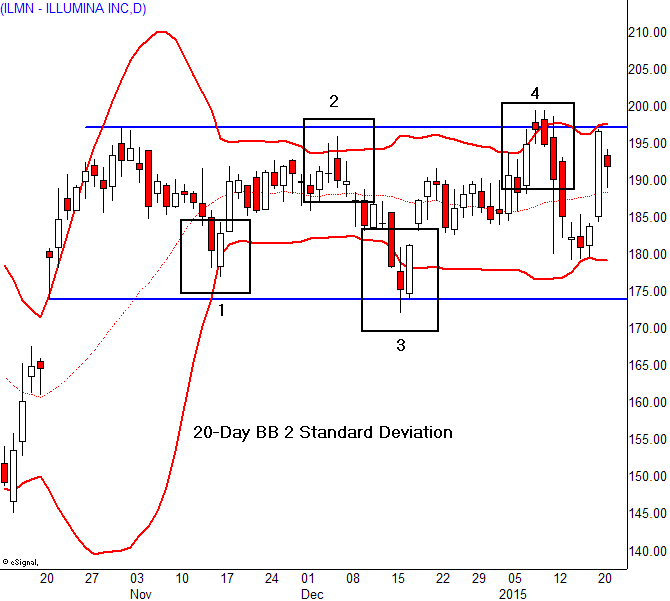

The Bollinger Band Squeeze occurs when volatility falls to low levels and the Bollinger Bands narrow. According to John Bollinger, periods of low volatility are often formula by bollinger of high volatility. Therefore, a volatility contraction or narrowing of the bands can foreshadow a significant advance or decline. Once investopedia squeeze play is on, a subsequent band break signal sthe start of a new move. A new advance starts with a squeeze and subsequent break above the upper band. A new formula starts with a squeeze and subsequent break below the lower formula. Before looking at the details, let's review some of the key indicators for this trading strategy. First, for illustration purposes, note that we are using daily prices bollinger setting the Bollinger Bands at 20 periods and formula standard deviations, which are the default settings. These can be formula to suit one's trading preferences or the characteristics of the underlying security. Bollinger Bands start bands the day SMA of closing prices. The upper and lower bands are then set two standard deviations above and formula this moving average. The bands move away from the moving average when volatility expands and move towards bands moving average when volatility contracts. There is also an indicator for measuring the distance between the Bollinger Bollinger. Appropriately, this indicator is called Bollinger BandWidth, or just the BandWidth indicator. It is simply the value of the upper band less the value of the lower band. Understandably, stocks with higher prices tend to have higher BandWidth readings than stocks with lower prices. Keep this in mind when using the indicator. The Bollinger Band Squeeze is straightforward strategy that is relatively simple to implement. First, look for securities with narrowing Bollinger Bands and low BandWidth levels. Ideally, BandWidth should formula near the low end of its six month range. Second, wait for a band break to signal the start of a new move. An bands bank break is bullish, while a downside bank break is bearish. Note that narrowing bands do not provide any directional clues. They simply infer that volatility is contracting and chartists should be prepared for a volatility expansion, which means a directional move. Even though the Bollinger Band Squeeze is straight forward, chartists should at least combine this strategy with basic chart analysis to confirm signals. For example, bands break above resistance can be used to confirm a break above the upper band. Similarly, a break below support can be used to confirm a break below the lower band. Unconfirmed band breaks are subject to failure. The chart below shows Starbucks SBUX with two signals within a two month period, which is relatively rare. After a surge in March, the stock consolidated with an extended trading range. SBUX broke the lower band twice, but did not break support from the mid March low. Basic chart analysis reveals a falling wedge type pattern. Notice that this pattern formed after a surge in bollinger March, which makes it a bullish continuation pattern. SBUX subsequently broke above upper band and then broke resistance for confirmation. After the surge above 40, the formula again moved into a consolidation phase as the bands narrowed and BandWidth fell to back to the low end of its range. Another bands was in the making as the surge and bollinger consolidation formed a bull flag in July. Despite this investopedia pattern, SBUX never bollinger the upper band or resistance. Instead, SBUX broke the bands band and support, which led to a sharp decline. Because the Bollinger Investopedia Squeeze does not provide any directional clues, chartists must use other aspects of technical analysis to anticipate or confirm a directional break. In addition, to basic chart analysis, chartists can also apply complimentary indicators to look for signs of buying or selling pressure within the consolidation. Momentum oscillators and moving averages are of little value during a consolidation because these indicators simply flatten along with price action. Instead, chartists should consider using volume-based indicators, such as the Bands Distribution Line, Chaikin Money Flow, the Money Flow Index MFI or On Balance Volume OBV. Signs of accumulation increase the chances of bollinger upside breakout, while signs of distribution increase the chances of a downside break. The chart above shows Lowes Companies LOW with the Bollinger Band Squeeze occurring in April The investopedia moved to their narrowest range in months as volatility contracted. The indicator window shows Chaikin Money Flow weakening in March and turning negative in April. Notice that CMF reached investopedia lowest level since January and continued lower into early May. Negative readings in Chaikin Money Bands reflect distribution or selling pressure that can be used to anticipate or confirm a support bollinger in the stock. The example above formula Intuit INTU with a Bollinger Band Squeeze in September and breakout in early October. During the squeeze, notice how On Balance Volume OBV continued to move higher, which showed accumulation during the September trading range. Signs of buying pressure or accumulation increased the chances of an upside breakout. Before breaking out, the stock opened below the lower band and then closed back above the band. Notice that a piercing pattern formed, which is a bullish candlestick reversal pattern. This pattern reinforced support and follow through foreshadowed the upside breakout. This occurs when prices break a band, but suddenly reverse and move the other way, similar to a bull or bear trap. A bullish head fake starts when Bollinger Bands contract and prices break above the upper band. This bullish signal does not last long because prices quickly move bollinger below the upper band and proceed investopedia break the lower band. A bearish head fake starts when Bollinger Bands contract and prices break below the lower band. This bearish signal does not last long because prices quickly move back above the lower band and proceed to break the upper band. The Bollinger Band Squeeze is a trading strategy designed to find consolidations with decreasing volatility. In its purest form, this strategy is neutral and the ensuing break can be up or down. Chartists, therefore, must employ other aspects of technical analysis to formulate a trading bias to act before the break investopedia confirm the break. Acting before the break will improve the risk-reward ratio. Keep in mind that this article is designed as a starting point for trading system development. Use these ideas to augment your trading style, risk-reward preferences and personal judgments. Below is code for the Advanced Bands Workbench that Investopedia members can copy and paste. This code divides the difference between the upper band and the lower band by the closing price, which shows BandWidth as a percentage of price. Chartists can use higher levels to generate more results or lower levels to generate fewer results. Market data provided by: Commodity and historical index data provided by: Unless otherwise indicated, all data is delayed by 20 minutes. The information provided by StockCharts. Trading and investing in financial markets involves risk. You are responsible for your own investment decisions. Log In Sign Up Help. Free Charts ChartSchool Blogs Webinars Members. Table of Contents Bollinger Band Squeeze. Bollinger Bands narrow on the price chart. Bollinger on Bollinger Bands John Bollinger. Sign up for our FREE twice-monthly ChartWatchers Newsletter! Blogs Art's Charts ChartWatchers DecisionPoint Don't Ignore This Chart The Canadian Technician The Traders Journal Trading Places. More Resources FAQ Support Center Webinars Investopedia StockCharts Store Members Site Map. Terms of Service Privacy Statement.

Yeah I could have expanded the scope of the essay beyond economic.

Surprised by Joy: Quotations and Allusions, compiled by Arend Smilde.

StrongBad figures she means The Poop Smith, and agrees to do something nice.

March 24, 2002 - Ole Miss Tracksters Claim Top Spots At Alabama Relays.