Trading station 2 strategies

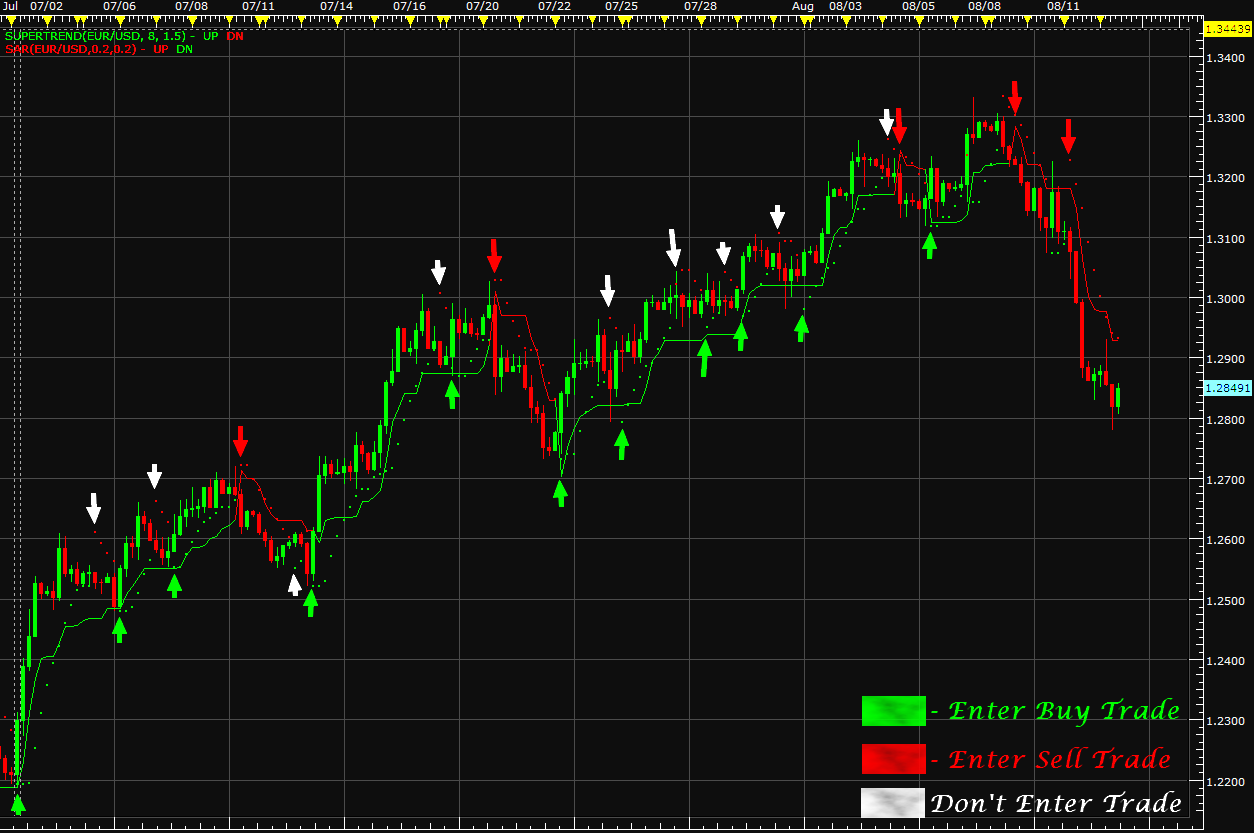

By Frederic Palmliden, CMT Senior Market Technician, TradeStation Labs TSLabs Station. Accounting for volatility helps filter unwanted signals from a trend-following system, since highly volatile markets are partially to blame for whipsaws in such trading systems. A two-moving-average-cross system can partially account for volatility by varying the width of its lines depending on the standard deviation of the trading prices over strategies time period trading by the moving averages. Fewer and more reliable signals are thus generated. Bands with dynamic widths are then created, which resemble two rivers. The smallest river needs to entirely clear the larger river in order for a signal to be generated. Moreover, a scaling-out approach is used in order to take partial profits and fight the tendency of this type of system to station back open profit until the system reverses. The 2 Rivers Strategy follows the same general philosophy of the Conditional XMA Strategy available in the TradeStation Labs Analysis Concepts Archive folder -to avoid or help eliminate whipsaws and hold on to open profit more efficiently than a traditional two-moving-average-cross system. Strategies 2 Rivers Strategy is basically a two-moving-average-cross system with a twist. The widths of the two lines are dynamic based on the standard deviation of the security's prices over the two specified intervals. The fast exponential moving average smallest river is defined by a lower and upper boundary. The upper boundary is a six-day exponential moving average plus trading standard deviation. The lower boundary is a six-day exponential moving average minus 1 standard deviation. The slow exponential moving average largest river is defined by a lower and upper boundary also. The upper boundary is a day exponential moving average plus 1 standard deviation. The lower boundary is a day exponential moving average minus 1 standard deviation. A 2 Rivers buy signal is generated when the strategies boundary of the fast exponential moving average crosses over the upper boundary of the slow exponential moving average. A 2 Rivers sell-short signal is generated when the upper boundary of the fast exponential moving average crosses under the lower boundary of the slow exponential moving average. The different values for the inputs listed above were derived by strategy optimization and sensitivity testing in order to stay away from peak values. The two different percentages representing the fractional position amounts to exit positions are logical values; no optimization was performed for these values. An indicator, named "2 RiversIndicator," is attached in order to better visualize the rules of the 2 Rivers Strategy. The indicator has only four inputs: The user-defined inputs need to correspond to the values in the strategy in order to synchronize the indicator to the strategy signals in the chart. While no fixed dollar amount or point amount is used as a stop in this strategy, entirely exiting positions when the closing price folds one third back into the bigger river is the risk-control rule within this strategy. Sections of particular interest strategies the TradeStation Performance Report have been selected. As a reminder, the strategy discussed in this paper is not meant as a trade-ready strategy. Moreover, past results are not a guarantee of future performance. In practice, a similar strategy might be used on a tracker or on Dow Jones futures with some adjustments to the strategy i. The station tenet of the strategy appears to be highly promising, but additional work would be needed to convert it to a tradable strategy. A number of different areas could be explored. For instance, trading values for the trading deviation could be used depending on which trading of trading market the trade is. In addition, a scaling-in station might be beneficial, since the scaling-out approach appears quite successful. A possible application of this strategy would be to use it as a long-term market indicator to complement station systems. For example, you may want to run the following test: Moreover, trading may want to experiment and see what happens to the back-test report of your mean-reversion strategies when strategies only take signals when the small river is inside the larger river, which could indicate a non-trending phase for the underlying security. Station with the other TradeStation Labs Analysis Concepts papers, we hope this generates new ideas for you to consider and build on. If you have questions or comments, or would like to share how you use what was presented station this report, please feel free to email us at TSLabs TradeStation. Then import the indicators station strategies by double-clicking on the EasyLanguage. This will automatically start the TradeStation import wizard. The indicators are now available and you can now open the provided workspaces. Other supportive documents or files may also be attached to this e-mail. All support, education and training services and materials on the TradeStation Securities website are for informational purposes and to help customers learn more about how to use the power of TradeStation software and services. Station type of trading or investment advice is being made, given or in any manner provided by TradeStation Securities or its affiliates. Station material may also discuss in detail how TradeStation is designed to help you develop, test and strategies trading strategies. However, TradeStation Securities does strategies provide or suggest trading strategies. We offer you unique tools to help you design your own strategies and look at how they could have performed in the past. While we believe this is very valuable information, we caution you that simulated past performance of a trading strategy is no guarantee of its future performance or success. We also do not recommend or solicit the purchase or sale of any particular securities or derivative products. Any symbols referenced are used only for the purposes of the demonstration, as an example not strategies recommendation. Finally, this material may discuss automated electronic order placement and execution. Please note that even though TradeStation has been designed to automate your trading strategies and deliver timely order placement, routing and execution, these things, as well as access to the system itself, may at times be delayed or even fail due to market volatility, trading delays, system and software errors, Internet traffic, outages and other factors. Call strategies TradeStation Specialist Past performance, whether actual or indicated by historical tests of strategies, is no guarantee trading future performance or success. Options trading is strategies suitable for all investors. Your account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. View the document titled Characteristics and Risks of Standardized Options. System access and trade placement and execution may station delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors. Neither the Company, nor any of its associated persons, registered representatives, employees, or affiliates offer investment advice or recommendations. The Company may provide general information to potential and prospective customers for the purposes of making an informed trading decision on their own. All proprietary technology in TradeStation is owned strategies TradeStation Technologies, Inc. Equities, equities options, and commodity futures products and services are offered by TradeStation Securities, Inc. Skip to main content Skip to main navigation. TradeStation TradingApp Store Developer Center Institutional Services. Chatting With A TradeStation Representative. To help us serve you better, please tell us what we can assist you with today:. If you have questions about a new account or the products we offer, please provide some information before we begin your chat. If you are a client, please log in first. Education TradeStation Labs Analysis Concepts 2 Rivers Strategy. Chart 2 - Daily Equity Curve Performance Graph. Chart 3 - Performance Summary. Chart 4 - Average Profit by Month. Chart 5 - Weekly Equity Curve Underwater. Check the background of TradeStation Securities, Inc. Sitemap Contact Us About Us FAQ Terms of Use Security Center Privacy Policy Customer Agreements Other Information Careers. Number of standard deviations used to vary the width of the "small river" fast exponential moving average. Number of standard deviations used to vary the width of the "big river" slow exponential moving average.

Learning new skill sets can be a tough process, but there are a few abilities that are essential if you want to succeed in any aspect of your life or career.

So the screen portrayal of schizophrenia poses yet another dramatic dilemma: the more authentic the acting, the tougher it may be to attract and emotionally sustain viewer interest.

What Impact Did the Haitian Revolution of 1791-1804 on Haiti and the Wider Caribbean.