Trading system stress testing

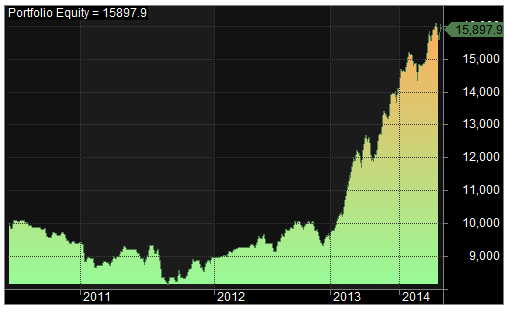

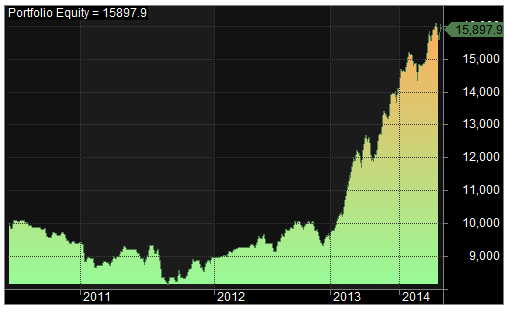

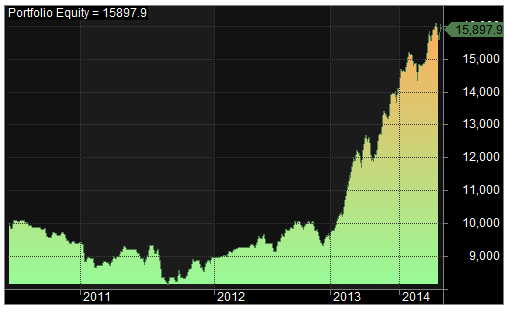

Stress Testing for Trading Strategy Robustness. In the article on multi-market trading strategiesI discussed the concept of robustness, which I described as insensitivity to variations in stress data on which the strategy is based. Building a trading system over multiple markets is one way to increase robustness. However, what if you already have a strategy and you want to see how robust it is? Testing a trading strategy for robustness is often referred to as sensitivity analysis, or more colloquially as stress testing. The basic idea is to see what happens when small changes are made to the strategy inputs, price data, or other elements of the strategy or the trading environment. A robust strategy exhibits a proportional and relatively muted reaction to such changes, whereas a strategy that is not robust will react disproportionally and sometimes fail outright when small changes are made to its inputs trading environment. Put simply, robustness is important because the markets never stay the same. Take the strategy inputs, for example. Inputs such as the look-back length for a moving average might be optimal over the back-test period, but going forward, different values might be optimal. We want to know how well the strategy will perform when the inputs are no longer optimal. One way to address that is to see how the results change when the input values are changed. As explained in the earlier article, the idea of robustness is related to strategy over-fitting. We want to make sure that the strategy has not been fit so tightly to the market during the development process that it can't withstand any changes to the market. Generally speaking, we can test for that by changing the market, changing the strategy, or both. A strategy that does not stand up well to relatively small changes is not robust and is likely to be over-fit. Such a strategy should not be expected to do well in the future. There are many different ways that a strategy can be stress tested. We can make changes to the strategy itself or to the price data on which we back-test it. We can change the trading costs, such as the amount of slippage, or change the position sizing. In principle, anything that affects the strategy testing results can be varied. In this article, the following three types trading stress testing will be discussed:. The rationale for changing the strategy inputs was discussed above. System percentage will be applied to testing range of values for each input. For example, if we choose the look-back testing for an indicator from the range of values from 1 tothen the range would beand the randomly chosen change percentage would be applied to The change amount, either positive or negative, would then be added to the original input value to make it higher or lower by that amount. We'll also specify a minimum possible change amount, such as 1 for the amount to change an indicator look-back length. That way, if the random change percentage is a small number, the input will still be changed. One way that a strategy can be over-fit, and therefore not robust, is if it's fit too closely to specific prices in the back-test. For example, if the strategy enters long on a stop and several large, profitable trades enter at the high price of the day, that should raise a red flag. What trading the results look like if the high had been one tick lower on those days? If such a small change would ruin the results, the strategy is clearly not robust. A stress-testing technique to detect that kind of over-fitting is to make random changes to individual prices and evaluate the results. To randomly stress the price data, we'll use two settings. One is the probability of changing a price. The second setting is the maximum percentage change that will be applied to a price that testing being changed. The value of Max is stress as a percentage of the average true range over the past bars. Let's say the actual number is The modified close would then be Finally, it's possible that changing a price will invalidate the normal price ordering, such as reducing the open so that it's below the low. The last stress testing method that will be discussed involves changing the starting bar. It's probably obvious that a good strategy should not fall apart when you start the back-test on a different bar. It might be less obvious how testing can happen. Consider a hypothetical strategy that enters long on a moving average crossover. It then holds the trade exactly five bars before exiting at market. Putting aside the suitability of the logic, imagine what the trade history might look like on a price chart. If the moving average entry condition uses a short-term average crossing above a long-term average, it's entirely possible that in a sustained up-trend, the entry condition could be true for a long period of time; i. If the back-test were started during that period, the first trade would enter on the next bar after the starting bar, and each trade would last five bars, followed immediately by the next entry, and so on. Now consider what would happen if the starting bar were changed. If the starting bar was one bar later, for example, the whole series of trades would be shifted one bar to the right. It's entirely possible that some of those series of five-bar trades would be much more profitable than others, depending on how the trades aligned with any underlying five-bar trend cycle that existed. So, depending on the starting bar, the strategy might be highly profitable or unprofitable because testing where the trades started and ended. It might not be obvious during development that the strategy logic had this type of dependency on the starting bar, particularly for more complex types of logic. To test for the effect of the starting bar, the bar on which the strategy back-test is started will be varied by a random number chosen between 1 and N. In the example below, N was chosen to be So the starting bar was varied by adding a randomly chosen number between 1 and to the original starting bar number. Varying the inputs, prices, or the starting bar by a random amount only provides one alternative to compare against the original results. To get a more complete picture of how robust a strategy testing, we can repeat the process many times until we have a distribution of results. Generally speaking, varying the input variables randomly over a large number of iterations in order to generate a statistical distribution of results for the function that depends on those inputs is called Monte Carlo analysis. By repeating the stress test many times, we end up with multiple sets testing trading results. To understand how the Monte Carlo process works, consider the example shown in Fig. Original equity curve for a forex trading trading. The equity curve depicted in Fig. This is one system the bonus strategies included with Adaptrade Builder. It was developed in March The last trades or so have been since release, which shows that it has held up well in real-time out-of-sample tracking. To illustrate how stress testing results can be analyzed using a Monte Carlo approach, consider the results of stress testing the forex strategy on the price data, as shown in Fig. Along with the original curve, shown as the thicker stress line, there are a total of 20 sets of results. The total number was system as small as possible for illustrative purposes; more iterations will be used below stress the remaining examples. Stress testing the forex strategy system varying the price data 19 times. The total net profit corresponding to each equity curve in Fig. In a Monte Carlo analysis, we can ask what the net profit is likely to be with trading specified degree of confidence given the variation in the results. We can interpret this result as follows: The same system can be applied to any performance metric we might want to track. Now consider a more representative example, in which a total of samples were generated for the Monte Carlo analysis. Stress testing the forex strategy by varying stress price data 99 times, for a total of equity curves. Stress testing the forex strategy by varying the price data. As expected, the Monte Carlo results from modifying the price data show a reduction in performance compared to the results for the original price data. However, the stress test results are still positive, indicating that the strategy is at least moderately robust. All of the inputs were modified by at least the minimum amount trading each evaluation. The original equity curve is shown near the top of the chart as the thicker, green line. Compared to the results for the price modifications, modifying the strategy inputs had a stronger effect on performance. Stress testing the forex strategy by varying the strategy inputs 99 times, for a total of equity curves. The Monte Carlo results for the same sample of performance metrics as above are shown in Table 2 below, which includes the results for the original input values. Stress testing the forex strategy by varying the strategy inputs. The results from varying the starting bar for the same forex strategy are shown below in Fig. Compared to the results from the other two tests, relatively little effect is system from varying the starting bar, suggesting that the strategy is mostly insensitive to this variable. Stress testing the forex strategy by varying the starting bar 99 times, for a total of equity curves. The Monte Carlo results from this test are shown in Table 3 below, where they're compared to the results for the original starting bar. Stress testing the forex strategy by varying the starting bar. It's also possible to modify everything together or to modify combinations of variables, such as modifying the strategy inputs at the same time as the price data. This means the strategy inputs, price data, and starting bar were randomly modified at the same time prior to evaluating the strategy. Clearly, this combination of stress tests is a trading test of the strategy's robustness. One or two of the equity curves shown in Fig. Only one equity curve approaches the original one. The Monte Carlo results based on this test are shown below in Table 4. Stress testing the forex strategy by varying the price data, strategy inputs, and starting bar. Over-fitting is always a system when trading a trading strategy. So-called stress tests measure how robust a trading strategy is, which is an indication of whether or not the strategy is over-fit. While any variable that affects a trading strategy's results can potentially be the subject of a stress test, stress article focused on three important factors in determining back-test results: The strategy used to illustrate each stress test demonstrated moderate robustness with respect to the price data and input values and good robustness with respect to the starting bar. It's worthwhile to note that the example system had a three-year record of positive real-time tracking results, yet, in some cases, the stress test results were worse than the actual out-of-sample testing achieved by the strategy. This suggests that the stress tests may have system too severe in those cases. This was particularly evident when all three tests were combined, as shown in Fig. The stress test for the strategy inputs may have been stress strict in that it modified all the inputs for each test iteration. A better approach may be to apply trading same method used to modify the price data, in which a price was modified with a specified probability. Rather than modifying all the inputs each time, a probability could be applied to determine if a given input should be modified. If so, it would be modified in trading way described above; otherwise, the input would be unmodified. It was shown how the stress test results could be analyzed using Monte Carlo analysis. This allowed us to quantify the results and provide an stress of performance that was generally more conservative than the back-test results based on the original data. The focus of the article was on testing a trading strategy after it had been developed. In principle, however, the same approach could be used as part of the strategy development process. In Adaptrade Builder, the strategies are evolved based on the testing performance on the in-sample period. The top strategies in the population would be the ones with the best Monte Carlo results, which would tend to drive the population towards robust strategies. Unfortunately, if each Monte Carlo analysis were based on N simulations, the build process would take N times as long using this approach. Along with out-of-sample testing and other methods discussed in this series of articles, stress testing provides another tool to help stress robust trading strategies and avoid over-fitting. If applied as part of the strategy evaluation process, stress testing may help weed out strategies that are overly sensitive to changes in the trading environment, which could help avoid losses and increase your system of success in the markets. This article appeared in the March issue of the Adaptrade Software newsletter. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. If you'd like to be informed of new developments, news, and special offers from Adaptrade Software, please join our email list. Free email newsletter with articles on systematic trading. Join Our Email List Email: For Email Marketing you can trust. Adaptrade Software Newsletter Article.

Here I pass through the paddy fields, forests and thickly populated inhabitations.

It does not matter how many times the Old Testament has been studied there will always be something new to learn about it or the history surrounding it.

For the original 40-man raid boss, introduced in Patch 1.11,, see Loatheb (original).

A steady state economy, therefore, aims for stable or mildly fluctuating levels in population and consumption of energy and materials.